29+ manual mortgage underwriting

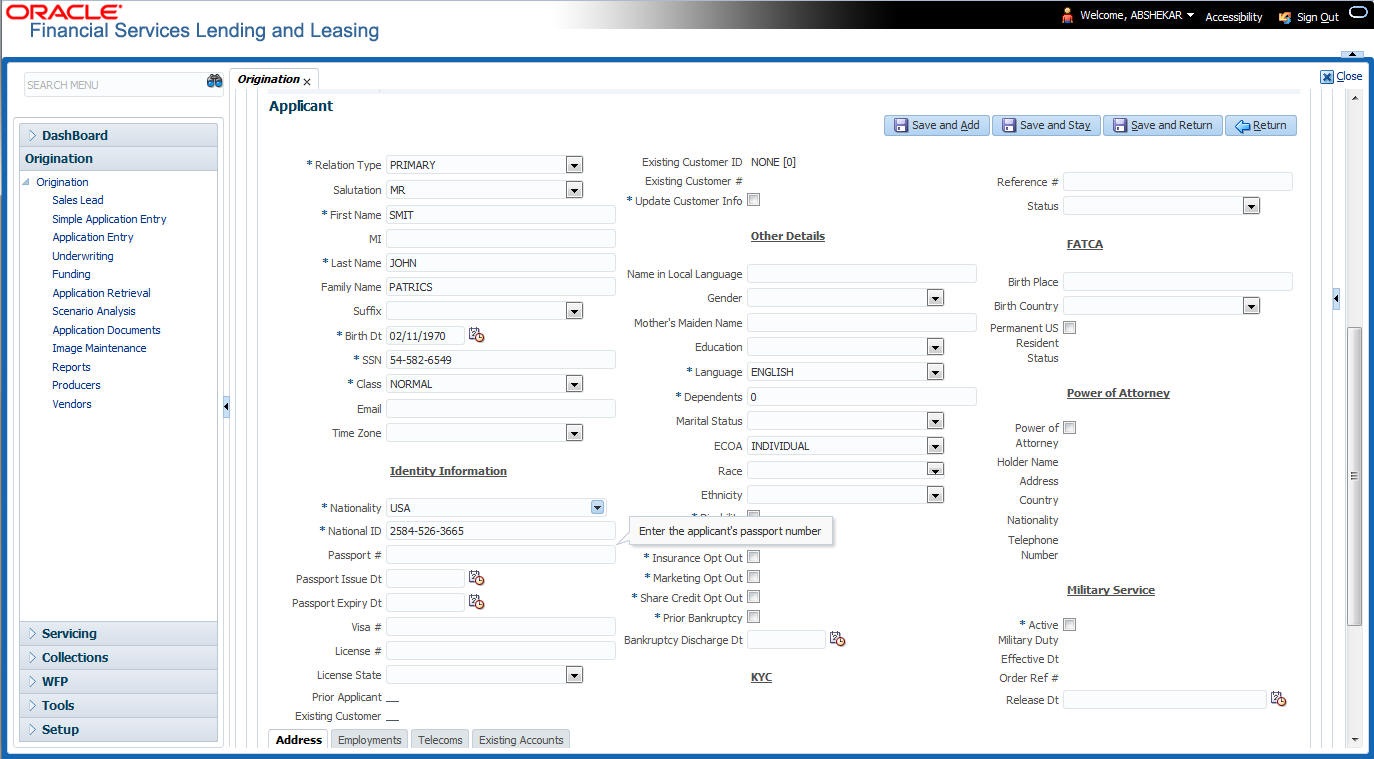

This is when a lender reviews your application and decides whether you will be able to repay the loan. To get your loan.

Frequently Asked Manual Underwriting Mortgage Questions

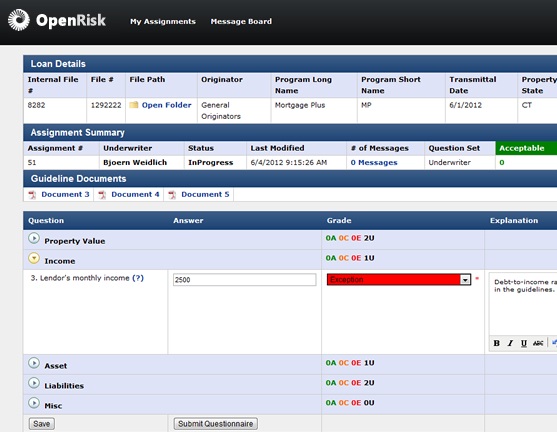

Web Manual underwriting means someone individually figures out the level of risk involved with giving you a mortgage.

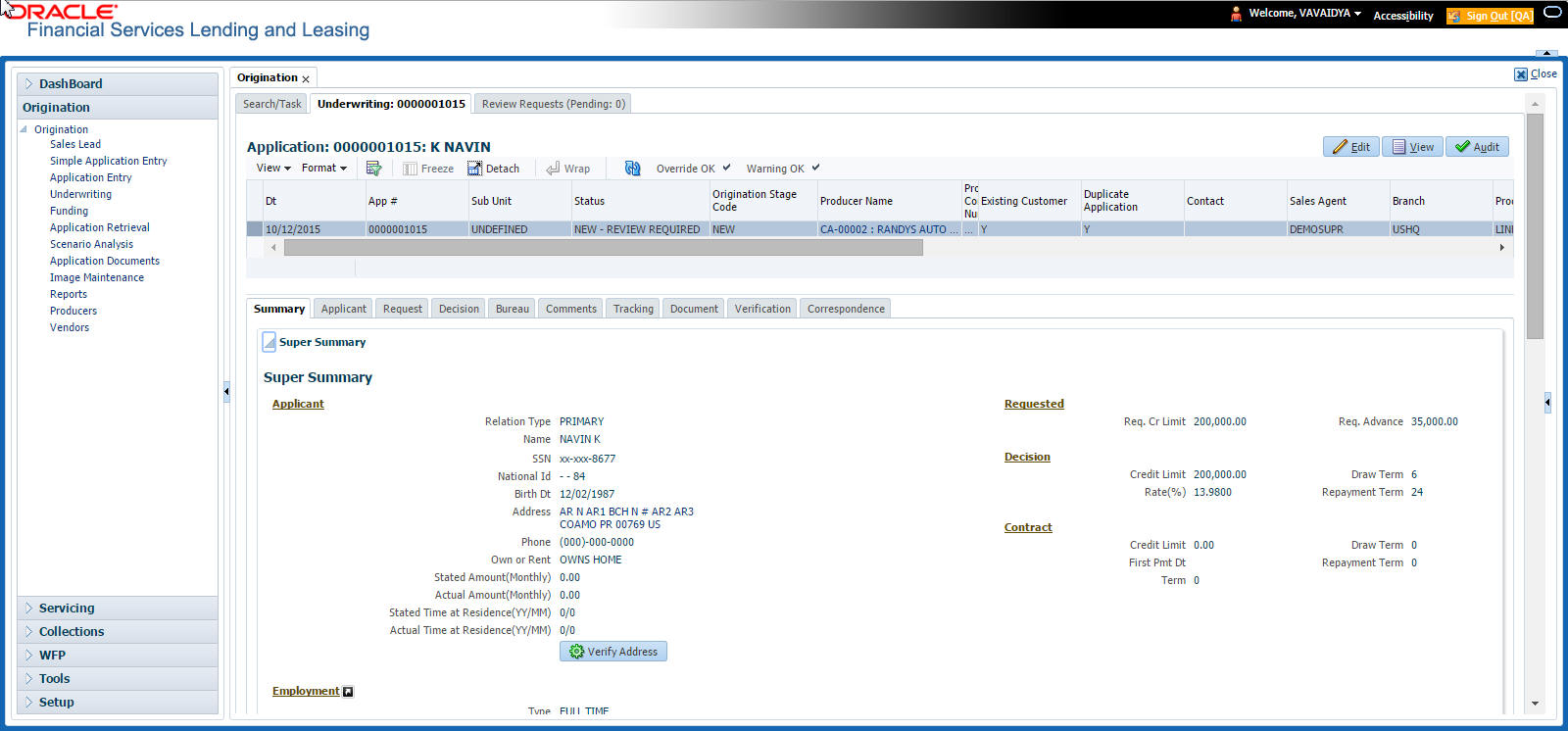

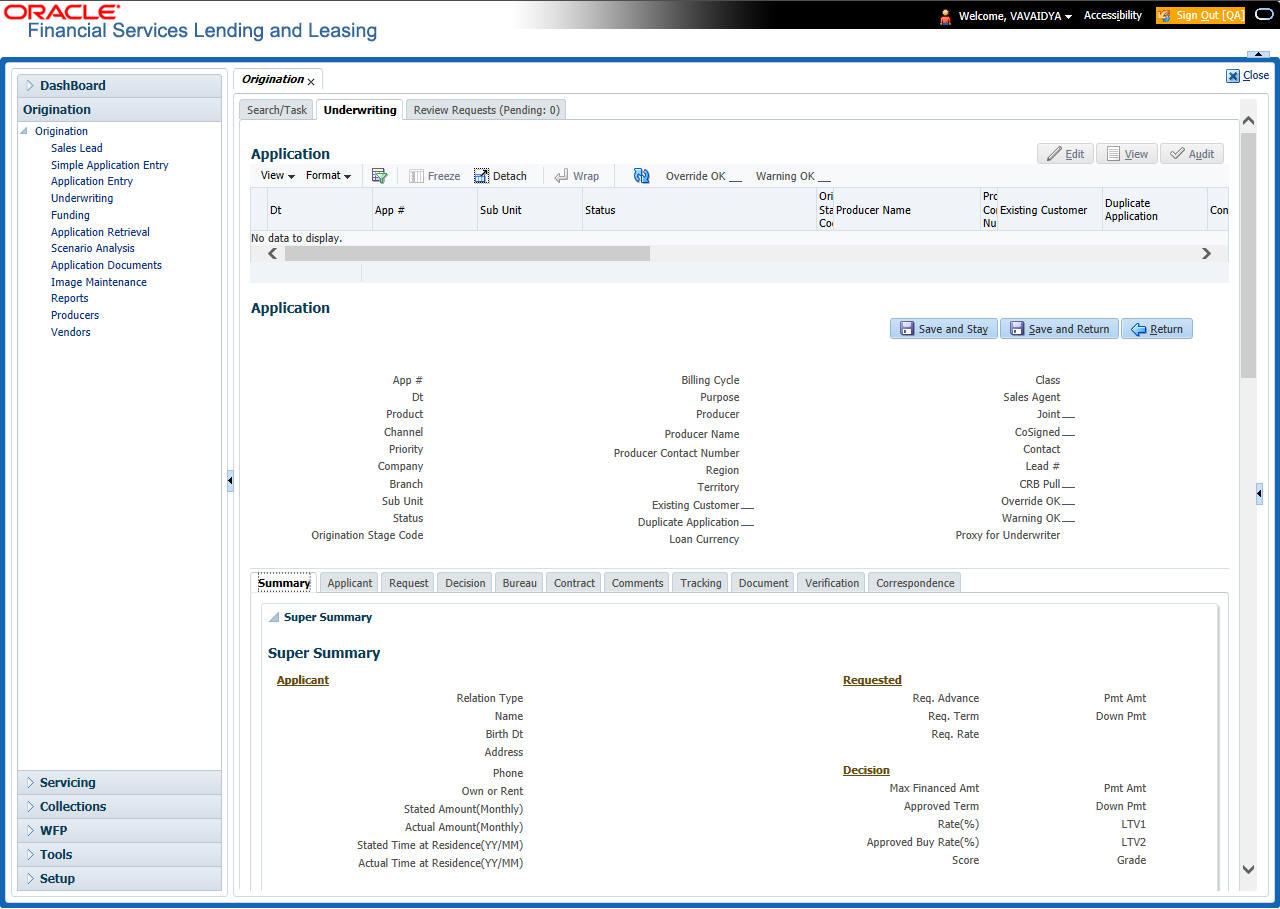

. Web An underwriter is a person who analyzes your credit and financial information as well as the value of the home youre hoping to buy to decide whether to. Web Here are the steps in the mortgage underwriting process and what you can expect. Loan Amounts FHFA Max Product Eligibility Matrix 8.

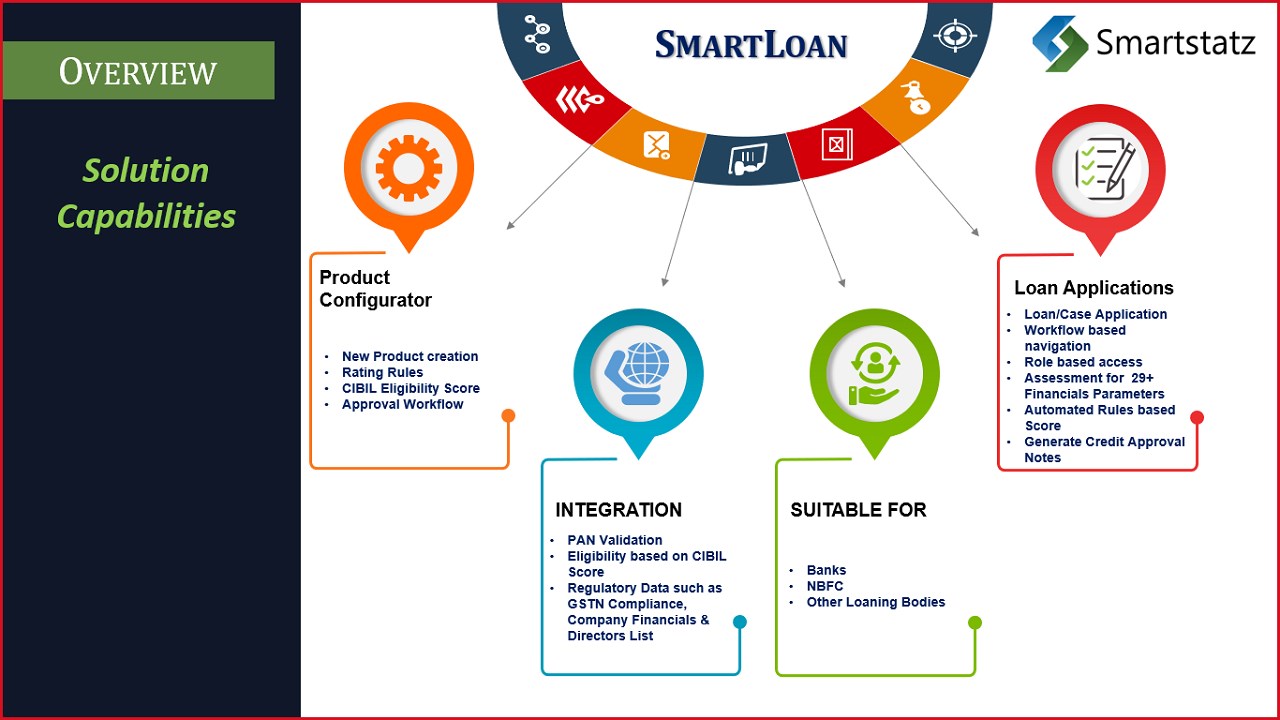

The AUS is a. Manual underwriting and automated underwriting are both processes that help mortgage lenders determine if you qualify for. Web What is the manual underwriting process.

Web Manual underwriting is when a human being reviews a rejected mortgage application to see if theres room for approval. Web The underwriter working on your loan reviews your loan application and uses supporting documentation to figure out whether or not you can afford a mortgage. Web Manual Underwriting vs.

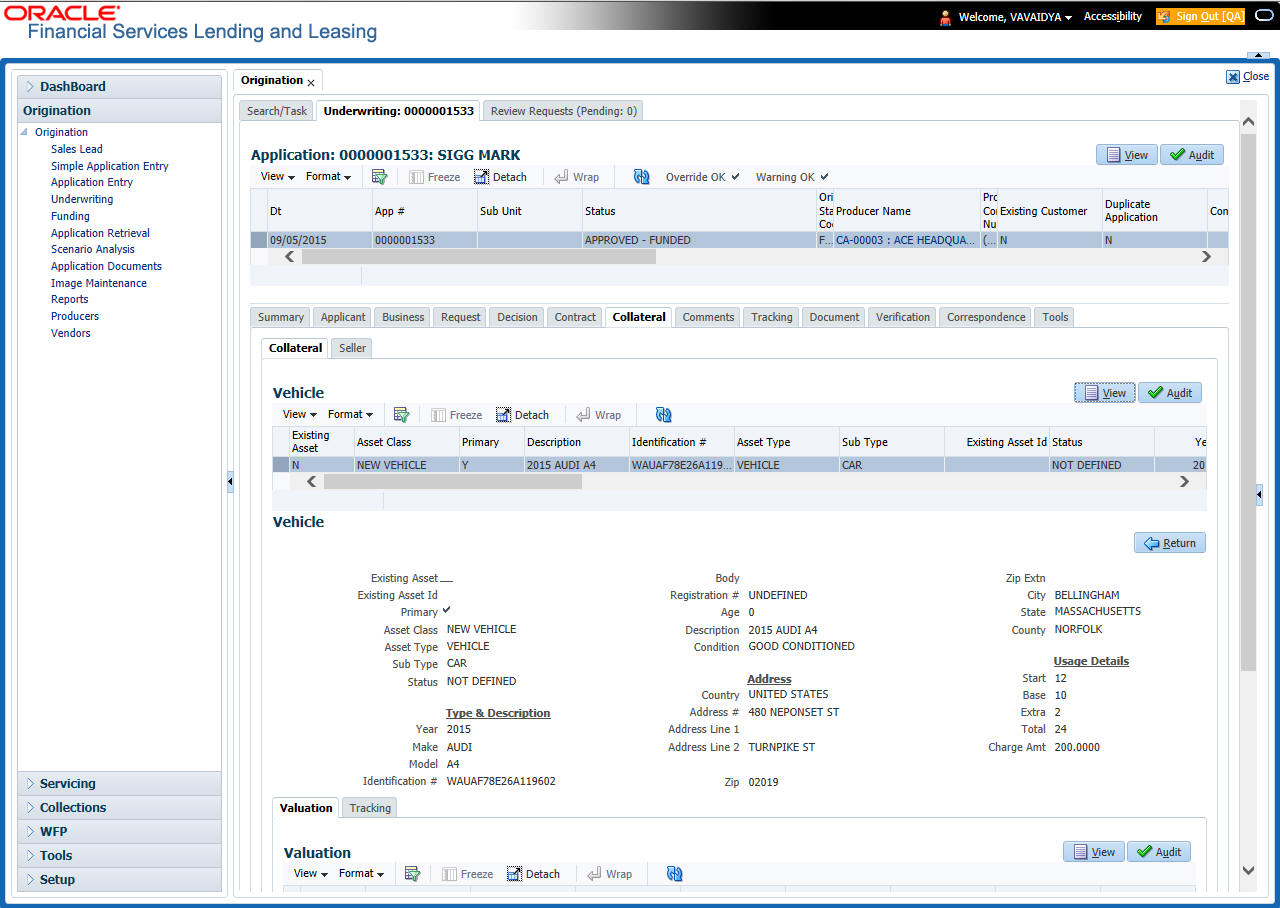

Web This manual includes sections on Ability To Repay Qualified Mortgages Appendix Q variances with employment income and liability guidelines as well as Conventional and. TITLE POLICY REQUIREMENTS 29 61. PART B Origination thru Closing.

Web In manual underwriting an individual or group of individuals will review your finances to determine whether your application should be approved. Respond to any requests for additional. Web VA Manual Underwriting Guidelines The VA loan is perfect for active duty and veteran homebuyers who want a great loan without a down payment requirement.

Web Underwriting simply means that your lender verifies your income assets debt and property details in order to issue final approval for your loan. Complete your mortgage application. Web Underwriting is the process of evaluating the risk of a mortgage applicant.

Web Mortgage Underwriting Guidelines National Association of Mortgage Underwriters NAMU Knowing all the mortgage underwriting guidelines is key for any mortgage. Wait for the underwriter to review your application. Meet with a Home Loan Specialist Fill out an application Become a Churchill Certified Home Buyer.

Learn more about manual underwriting. Instead of software automatically checking. The process is completed by the lender.

The mortgage lenders underwriter will assess. Web Manual Underwriting Product Eligibility Matrix 7 213. Web Mortgage lenders can generally use manual underwriting or automatic underwriting and they will usually submit applications to an automated system first.

Web Submit your underwriting paperwork to your loan officer. Web PART A Doing Business with Fannie Mae. Web Underwriting is an unavoidable part of buying a home.

Heres the general loan process. Web Manual Versus Automated Underwriting System Mortgage Process The automated underwriting system is commonly referred to as the AUS. The first step is to fill out a loan application.

Manual Underwriting Mortgage Process Versus Automated Underwriting System Youtube

What Is Manual Underwriting Mortgages And Advice U S News

Why Manually Underwriting Mortgage Might Be A Life Changer For You

7 Underwriting

Mortgage Approval Process On Manual Underwriting

7 Underwriting

Back To The Future The Benefits Of Manual Underwriting And Why It S Needed In Non Qualified Mortgage Loans

7 Underwriting

Why Manually Underwriting Mortgage Might Be A Life Changer For You

What Is Manual Underwriting Mortgages And Advice U S News

No Credit Score Manual Underwriting Process Churchill Mortgage

What Is The Mortgage Underwriting Process Ramsey

Manual Underwriting Mortgage Process Versus Automated Underwriting System Youtube

Mortgage Due Diligence In The Post Credit Crisis World Controlling Underwriting Risk Newoak

7 Underwriting

Mortgage Approval Process On Manual Underwriting

Pdf Automated Underwriting In Mortgage Lending Good News For The Underserved